OVERVIEW

The NSW Budget for 2023-24, the first delivered by NSW Treasurer Daniel Mookhey, has a strong focus on housing, energy, and health, but light on business.

Significant investments in housing ($2.2 billion Housing Infrastructure Plan), regional health ($3.8 billion) and energy ($1.8 billion for the Transmission Acceleration Facility and the Energy Security Corporation), will assist businesses in getting the workers they need, help regional communities thrive and keep energy costs lower.

Housing is a central pillar to this NSW budget, and we are encouraged by the proactive measures outlined by the government to begin the work of solving the state’s housing crisis.

While welcoming the NSW Government’s commitment to no new taxes or tax increases for business, Business NSW is seeking clarity from the government on a decision to remove the exemption on company restructures and adding a 10% concessional duty.

FISCAL & ECONOMIC OUTLOOK

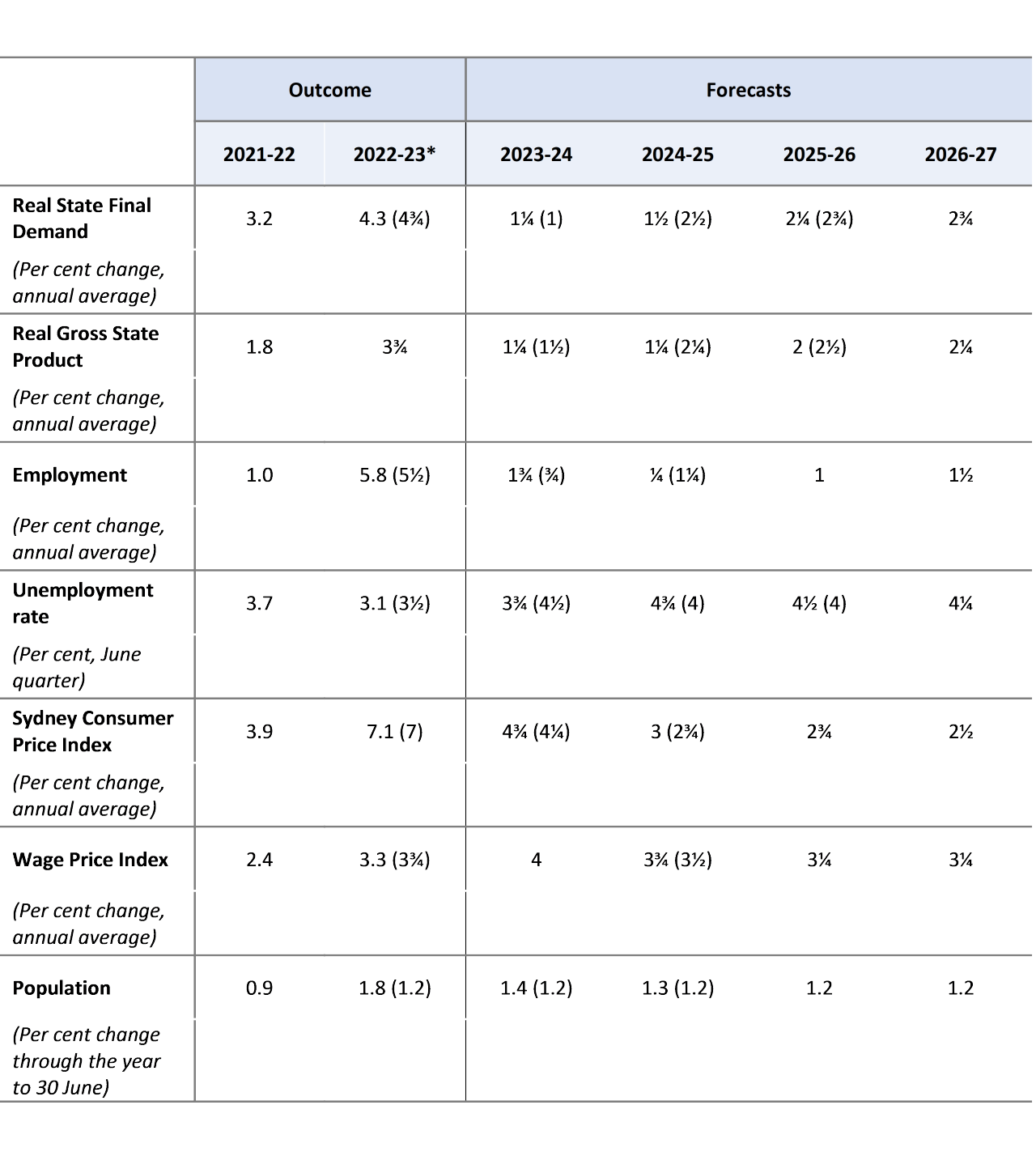

NSW economic growth: Real gross state product growth is projected at 3.75% for 2022-23 (a downward revision from last Budget’s projection of 4.25%). Economic growth for 2023-24 is forecast to slow to 1.25% (slightly lower than the forecast of 1.5% in the 2023 Pre-election Budget Update), but the forecast for 2024-25 has been substantially revised from 2.25% to 1.25%.

Unemployment: The unemployment rate is forecast to rise to 3.75% in 2023-24 (compared to last Budget’s forecast of 3.5%), after ending 2022-23 at 3.1%. A further increase to 4.75% is expected in 2024-25 (a large upward revision from 3.5% in last year’s Budget and 4% in the 2023 Pre-election Budget Update).

Inflation: Sydney CPI growth is forecast to moderate from 7.1% in 2022-23 to 4.75% in 2023-24 and 3% in 2024-25. (Note: The RBA’s inflation target range is 2%-3%.)

Wage growth: Wage price growth is forecast to accelerate from 3.3% in 2022-23 to 4% in 2023-24 (still below the corresponding Sydney inflation forecast). However, wage growth is forecast to start exceeding Sydney inflation from 2024-25.

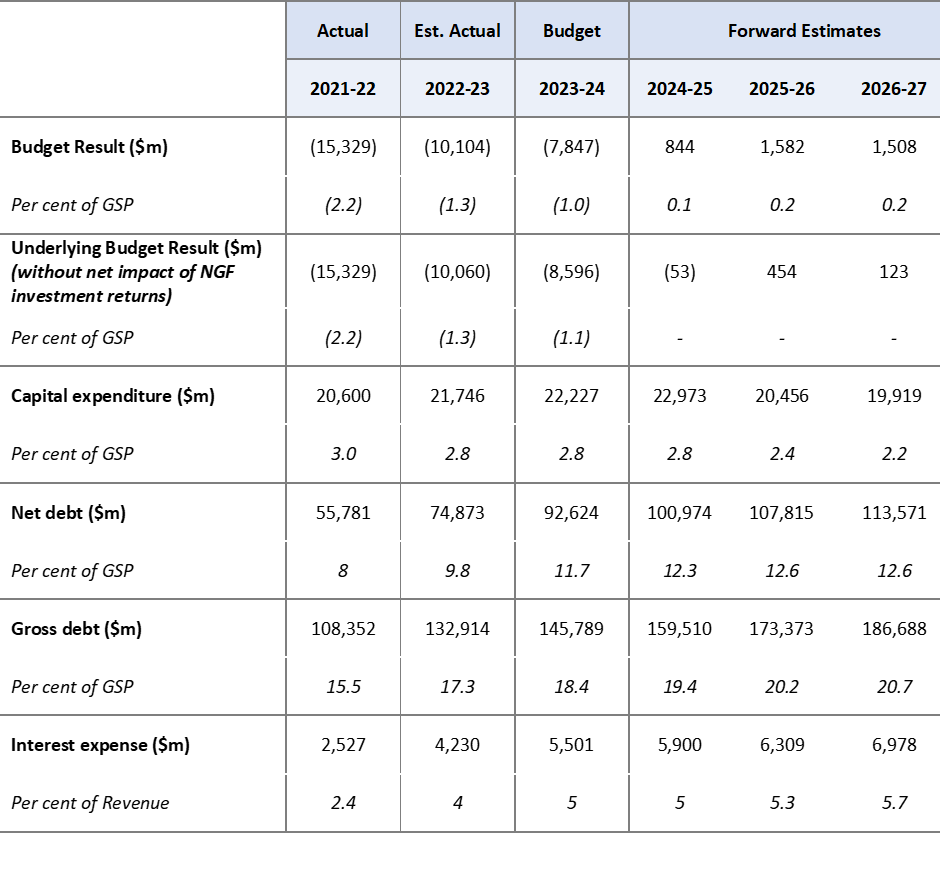

Budget result & net debt: A budget deficit of $7.8 billion (1.0% of GSP) is estimated for 2023-24 (larger than the previous estimate of $2.8 billion provided in the last Budget). A small budget surplus of $844 million (0.1% of GSP) is projected for 2024-25. Net debt is estimated to widen from $74.9 billion (9.8% of GSP) in 2022-23 to $92.6 billion (11.7% of GSP) in 2023-24, and further increase to 12.3% of GSP in 2024-25 before stabilising at 12.6% in 2025-26.

Table 1: New South Wales economic performance and outlook

Note: Previous forecast (2023 Pre-election Budget Update) in parenthesis where different. *2022-23 figures are outcomes for all metrics except real gross state product and population, which are forecasts.

Source: Budget Paper No. 1 - Budget Statement - Budget 2023-24, NSW Treasury

Table 2: Key Budget aggregates for the general government sector

Source: Budget Paper No. 1 - Budget Statement - Budget 2023-24, NSW Treasury

HIGHLIGHTS FOR BUSINESS

This section outlines key measures for business and also highlights Business NSW advocacy wins for the business community.

HOUSING

ADVOCACY WIN Housing and Infrastructure Plan: $2.2 billion investment in new housing and infrastructure to increase housing supply. This includes $300.0 million reinvested dividends to deliver 1,409 affordable homes and 3,299 market homes by 2039-40 via Landcom; $400.0 million in Restart NSW for the new Housing Infrastructure Fund; and $1.5 billion for housing-related infrastructure through the Housing and Productivity Contribution .

ADVOCACY WIN Essential Housing Package: a $224 million package to accelerate the delivery of social, affordable and private homes ($70 million); continue to provide housing services for First Nations households ($35.3 million); support critical social housing maintenance ($35.0 million); provide dedicated mental health housing through Restart NSW ($20.0 million); establish a NSW Housing Fund for urgent priority housing and homelessness measures ($15.0 million); extend the Together Home program ($11.3 million); inject funding to Temporary Accommodation in 2023-24 to address homelessness ($11.0 million); inject funding to the Community Housing Leasing Program ($10.5 million); and deliver faster quality social housing through Modular Housing Trial ($10.0 million); and allow Specialist Homelessness Services to address increasing demand ($5.9 million). A new agency, Homes NSW, will also be established.

ADVOCACY WIN Faster Planning Program: $38.7 million program to establish the NSW Building Commission to support high quality housing and protect home buyers ($24.0 million), assess housing supply opportunities across government-owned sites and delivering new social housing ($9.1 million), and implement an artificial intelligence pilot to improve planning system efficiencies ($5.6 million).

Appointment of NSW Rental Commissioner: to work with government to design and implement changes, including implementing a Portable Rental Bonds Scheme and legislating reasonable grounds for ending a lease to protect renters from unfair evictions.

Commonwealth Social Housing Accelerator Program: $610.1 million to permanently add around 1,500 social housing dwellings.

First Home Buyers Assistance Scheme: first-home buyers will save up to $30,735 through expanded stamp duty exemptions and concessions (from 1 July 2023).

Build-to-Rent trials: $60 million to trial build-to-rent development initiatives in the South Coast and Northern Rivers regions.

COST-OF-LIVING RELIEF

ADVOCACY WIN Toll relief for commuters and businesses: Long-term toll reform of $615 million to support motorists. A two-year program providing immediate relief through a $60 weekly toll cap for private motorists from 1 January 2024, and a 33% reduction in the truck toll multiplier on the M5 East and M8.

Early childhood education and care: $60 million for new and upgraded non-government preschools to increase affordable, high-quality preschools in areas of most need.

Making communities stronger and fairer: $13.8 million to improve women’s participation in the workforce.

GROWING & SUPPORTING THE WORKFORCE

ADVOCACY WIN Apprentices: $93.5 million to fund an additional 1,000 apprentices

Essential services fund: $3.6 billion to establish a new Essential Services Fund, focused on increasing the number of workers in key sectors such as teachers, healthcare workers and bus drivers.

Childcare workforce: $28.5 million to develop and grow the early childhood education workforce.

icare improvement program: icare’s multi-year improvement program focusing on effective embedment of governance and risk management, cultural improvements, improved return to work outcomes, improved claims servicing and better outcomes for the customers they serve.

SKILLS & INNOVATION

Investment in Education: $4.9 billion investment in schools across NSW ($1.4 billion of which will be allocated to regions), building 43 new schools, and upgrading a further 86.

ADVOCACY WIN Investment in Skills: $112 million for a thorough VET review and additional funding to cover the TAFE funding shortfall.

Tutoring programs: $278.4 million to fund permanent literacy and numeracy tutoring in primary and secondary schools.

ENERGY & ENVIRONMENT

ADVOCACY WIN Transmission Acceleration Facility: Government has committed $804 million (in addition to $1.2 billion committed under the previous government). The funding will support work in the state’s renewable energy zones including the Central-West Orana REZ, the Hunter Transmission Project and the Waratah Super Battery and is expected to drive 9,000 regional jobs. The expenditure will eventually be recouped from private investors and returned to the facility, allowing it to fund subsequent projects.

Energy Security Corporation: The $1 billion ESC will invest in storage projects that boost the reliability of the state’s electricity network and address gaps in the market as NSW transitions to renewables.

PARTIAL ADVOCACY WIN EV support changes: The government will end rebates and stamp duty exemptions for EV purchases saving it $527 million. In their place, the government will spend $263 million to deliver its revised Electric Vehicle Strategy including spending on EV charging infrastructure for drivers in regional NSW, renters, people who live in apartments and motorists who do not have access to home charging.

Coal royalties raised: Increases to coal royalty rates take effect from July 2024 and are expected to raise $2.7 billion over four years.

INFRASTRUCTURE & TRANSPORT

ADVOCACY WIN Parramatta Light Rail Stage 2: $200 million reserved to expedite the planning for procurement, construction and delivery.

ADVOCACY WIN Sydney Metros: Metro CBD and Southwest, Metro West and Metro Western Sydney Airport remain funded in the Budget pending completion of the comprehensive review of Sydney Metro. New estimates of the total costs of these projects were not provided.

ADVOCACY WIN Regional Emergency Road Repair Fund (RERRF): $390 million allocated to regional and rural councils for urgent road and pothole repairs.

ADVOCACY WIN Regional Roads Fund: $334 million to build new roads in regional and rural NSW

ADVOCACY WIN Improving access to health services: Investing $13.9 billion in health facilities including $120.0 million expansion of Blacktown and Mount Druitt Hospital, $190.0 million for upgrades at Royal Prince Alfred Hospital, and $1.3 billion rebuild of Bankstown Hospital.

Major projects cancelled and deferred: Northern Beaches Link tunnel project will not be progressed under current government, as will Dungowan Dam. The Great Western Highway upgrade and Circular Quay redesign have been deferred, while faster rail initiatives have been handed over to the Commonwealth and will not be progressed by NSW Government. Penrith Stadium rebuild has been replaced with a more modest redevelopment.

SUPPORT FOR REGIONS

Designation of regional Business Hubs: Wagga Wagga will receive $212 million to encourage sustainable high value agriculture and manufacturing production. Moree receives $224.8 million to become the state’s Northern Gateway and business hub. Parkes will be supported with funding of $332 million to develop its Inland Rail intermodal hub to transform Parkes into national freight and logistics hub.

Regional Health Facilities: $3.8 billion for improvement and new health facilities across regional NSW

New regional-focused funds established: creation of the $350 million Regional Development Trust Fund (aligned with Australian Government’s Regional Investment Framework) and the $250 million Working Regions Fund.

Regional Futures Jobs and Investment Authorities: Newly established authorities have been funded to guide transition from coal-based economy to alternative economic activities.

ADVOCACY WIN Flood-impacted regional housing: $150 million for NSW Land and Housing Corporation to deliver replacement, substitute and new social housing in flood-impacted locations

Independent Agriculture Commissioner: $5.5 million for protection for farmland and ensure food security.

SUPPORT FOR SMALL BUSINESS

ADVOCACY WIN Small Business Energy Rebates: The government confirmed funding for previously announced rebates on energy bills for small businesses of up to $650.

NSW Business Bureau: Government restated its commitment to establish a new agency to improve small business engagement with government regulation, procurement tendering and grants application processes, as well as engage with overseas markets.

OTHER BUSINESS MEASURES - TAX INTEGRITY AND FAIRNESS CHANGES

Land Tax exemption for principal place of residence: The threshold for claiming Land Tax exemption for principal place of residence has increased from 1% to 25%.

Transfer duty exemptions for company restructures: The concession will be removed and a 10% duty applied commencing 1 February 2024.

Tax compliance - $111.1 million over 4 years to boost Revenue NSW’s tax compliance activities is expected to increase revenue including $337 million from payroll tax and $225 million from transfer duties.

For more information from Business NSW, please contact:

Ben Pike – Executive Manager, Marketing & Media: Ben.Pike@businessnsw.com

ECONOMIC UPDATE & NSW BUDGET 2023-24 WEBINAR

Business NSW is hosting an exclusive webinar on Wednesday 27th of September, featuring Dr Sherman Chan (Business NSW Chief Economist) and Ben Pike (Executive Manager, Media and Marketing). This webinar is your chance to cut through the noise of the NSW Budget coverage and find out what it actually means for your business, with the ability to also ask questions.