OVERVIEW

- Budget for our times: The NSW Treasurer delivered a Budget designed to support the next phase of our recovery. Businesses will benefit from a range of new support measures with significant new stimulus to support the economy and investments to ensure NSW’s resilience in the fight against COVID-19. The Budget responds to proposals put forward in our pre-Budget submission and our COVID-recovery plan Back on track.

- Payroll tax and small business support: This Budget delivers some significant advocacy wins for Business NSW with $2.4 billion worth of cuts to payroll tax and incentives for businesses that relocate or expand their jobs footprint in NSW. There is also relief from government fees and charges for smaller businesses that do not pay payroll tax.

- Reform: The Budget proposes reforms to state based taxes and regulation and new pathways to access education and training for mid-career changes.

HIGHLIGHTS FOR BUSINESS

- Payroll tax thresholds and cuts: The payroll tax threshold will be increased to $1.2 million with the rate of payroll tax lowered from 5.45 to 4.85 per cent for the next two years. The threshold increase alone will deliver an annual saving of $10,900 (for businesses above the new threshold), with further savings over the next two years due to the lower rate. Recent Business NSW advocacy has resulted in a $450,000 increase to the threshold, saving the typical business close to $25,000 and exempting thousands of businesses from payroll tax.

- Dining and entertainment vouchers: $500 million will be allocated to deliver four $25 vouchers to every NSW adult to spend at entertainment and hospitality venues. This measure will provide a much-needed temporary boost to customer demand in some key parts of the economy that are struggling.

- Fee relief for SMEs: SMEs that do not pay payroll tax will receive a $1,500 digital voucher to use against the cost of NSW Government fees and charges.

- Job creation: Under the $250 million Jobs Plus program, businesses that create more than 30 jobs will be exempt from paying payroll tax on any additional jobs beyond this threshold for four years. This policy is aimed at attracting new investment in NSW, including businesses looking to expand or relocate to NSW.

- Targeted support: The NSW Budget provides relief for areas of the economy hardest hit by COVID-19 such as tourism, hospitality and the arts. This includes $15 million to revitalise the Sydney CBD and $175 million in funding for investment in new film and television projects. Funding for business advice will be expanded with $39 million in funding for Business Connect.

- Infrastructure: The NSW infrastructure pipeline has expanded to $107.1 billion which is expected to generate 145,000 jobs. While the Budget does not announce any significant new projects, the Government has focussed on fast-tracking targeted investments in shovel ready-projects to boost demand in the near term.

- Regional NSW: In addition to existing drought and bushfire relief, regional NSW will benefit from $8.7 billion in regional road and transport infrastructure spending. The Regional Growth Fund which provides funding for community upgrades and projects, has been expanded by $300 million. More than 90 new and accelerated regional projects totalling $1.8 billion have been supported by the Jobs and Infrastructure Acceleration Fund.

- Promoting NSW in international markets: The NSW Government is allocating $180 million to boost exports, including by expanding its footprint of international trade offices and industry support programs.

- Skills and education: $80 million will be allocated to support the creation of new apprentices, trainees and cadets on social housing projects delivered by the NSW Land and Housing Corporation. Women will be supported by $5,000 grants for training and support to return to the workforce while $17 million will be spent for upskilling, mentoring and job matching for people working in the care economy.

- Tendering support: The Small Business Commission has been provided $5 million for a tender support program with practical assistance to help businesses prepare and submit tender documents.

REFORM

- Property tax reform: Business NSW has long advocated for the need for state-based tax reform. In a significant advocacy result, the Treasurer announced a proposal for property tax reform with a plan to replace stamp duty with an annual tax on land value. Under the proposal, homebuyers would be able to choose whether to pay stamp duty or the new land tax. It is estimated the proposal would boost the NSW economy by 1.7 per cent. The Government is seeking stakeholder feedback on the proposal.

- Skills and education: The Government will develop a new model to support the entry of mid-career professionals into teaching. Building on recent recommendations made in the Productivity Green paper, the Budget also announced skills reforms to introduce new pathways into trades, particularly for mature workers and women.

- Regulation and innovation: The NSW Government will work with the Commonwealth and other states and territories on automatic mutual recognition arrangements to streamline requirements for those who obtain occupational licenses in a different jurisdiction to the one they work. The NSW Treasurer will lead a whole-of-government evaluation of targeted regulatory relaxations implemented during the pandemic with a view to retaining the best of these reforms.

FISCAL OUTLOOK

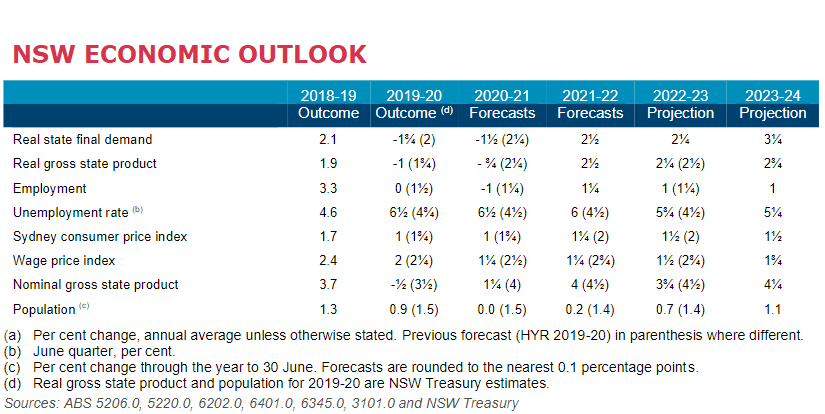

- Outlook for NSW: Following a contraction of 1 per cent in 2019-20, economic activity is expected to fall by a further ¾ per cent in 2020-21, with growth rebounding to 2½ per cent in 2021-22. These forecasts are underpinned by an assumption that a vaccine will start to roll out in the middle of 2021 with social distancing restrictions in place until a vaccine is widely available.

- Unemployment rate yet to peak: Unemployment is likely to rise in the coming months but is expected to decline before the end of this financial year. It is expected to be around 6 per cent in 2021-22 with employment growth improving at this time.

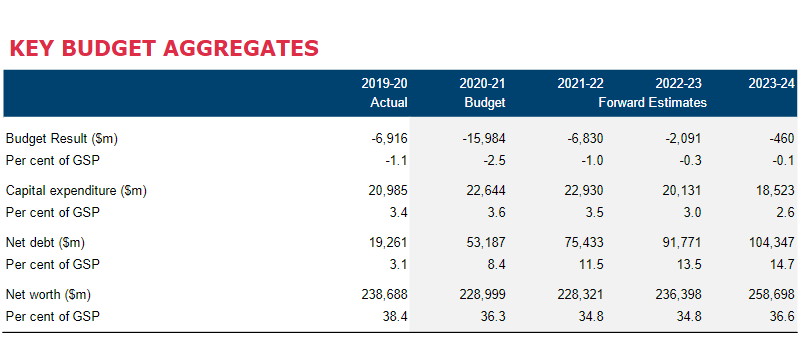

- Debt and deficit: A deficit of $6.9 billion was recorded in 2019-20 with a $16 billion deficit expected for 2020-21, which at 2.5 per cent of Gross State Product is a record deficit for NSW. Net debt is projected to increase to 14.7 per cent of Gross State Product by June 2023 with asset recycling to decrease towards 7 per cent over the medium term.